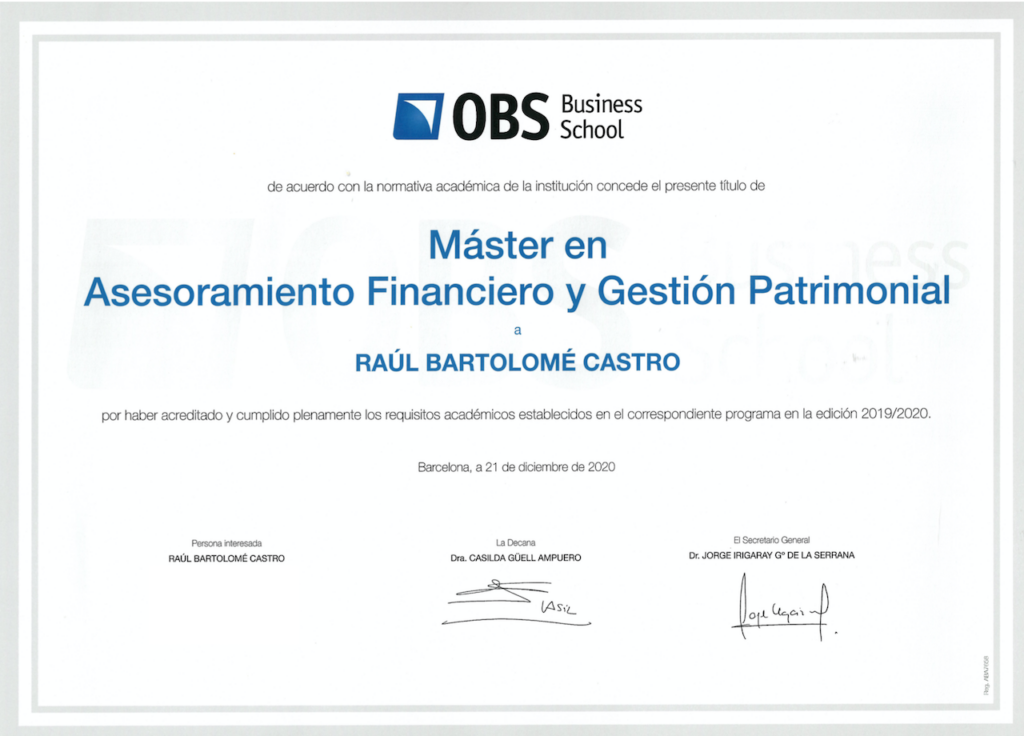

- Title: “Máster en Asesoramiento Financiero y Gestión Patrimonial”. In English: Master in Financial Advice and Asset Management

- Years: 2019-2020

- University: Universitat de Barcelona and OBS Business School

- Location: Barcelona, Catalonia, Spain

- Thesis: “Asesoramiento financiero para una cartera de 10 millones de dólares“. In English: Financial advice for a portfolio of 10 million dollars

The program

The Master in Financial Advice and Asset Management provides its participants with a broad and complete knowledge of the area of wealth and portfolio management, complete with an extensive introductory block to learn how financial markets and financial entities work.

The program is designed so that students finish the program with more powerful skills and knowledge when developing their professional performance, both in the area of wealth management in entities such as private banking or wealth managers and in any other related job . This program is even suitable for those whose main objective is to better manage personal or family finances. Students will strengthen competencies in line with the trends of the global labor market demands and the requirements demanded by the main companies looking for an expert profile in wealth financial advice.

The curriculum includes a wide range of subjects that will be taught by teachers with both experience from the teaching point of view and from the practical point of view, as most of them are professionals in areas similar to the subjects they will teach. All these subjects will have a double angle including both a theoretical part that helps to solidify concepts and increase the technical capacities of the students, combined with exercises, practical cases and debates on current issues in which students have the opportunity to see in real situations , what is the impact and application of the theory studied.

Likewise, the program includes a Master’s Final Project (TFM) that will allow to connect and apply all the financial knowledge acquired during the program to a specific situation. The work will be carried out in a group and must be defended in court, bringing the student closer to the business reality that executives face every day. The work will include a simulation in which each team must propose and design an investment strategy based on the current market situation.

Finally, the program provides the student with the basic knowledge to obtain the EFA (European Financial Advisor) qualification. Having a professional certification for financial advice is vital in the medium term for finance professionals, since the financial guidelines at European level will require in the medium-long term that everyone who operates in financial markets as advisers be professionally qualified .

Goals

The program is designed to meet the following objectives:

- Provide students with a solid foundation of how financial markets work according to their typology, including fixed income, equity and currency markets anywhere in the world.

- Allow the student to delve into the personal analysis of a potential client and analyze what are the concerns or objectives that must be taken into account when recommending a certain investment.

- Allow the student to delve into the personal analysis of a potential client and analyze what are the concerns or objectives that must be taken into account when recommending a certain investment.

- Knowing the wide range of investment alternatives and delving into each one of them, identifying the advantages and disadvantages as well as their main characteristics.

- Delve into the psychology of investors and the concerns they have when making their investment decisions, including the wide range of personal and family decisions such as retirement planning, insurance, housing or tax.

- Help students who are willing to obtain the European Financial Advisor (EFA) accreditation, awarded by EFPA, to prepare it.

Modules taken

Module | Credits |

| Financial Advice | 5 |

| Economic environment | 5 |

| Finance system | 5 |

| Valuation Methodologies | 5 |

| Financial products | 5 |

| Collective Investment Institutions | 5 |

| Real Estate Planning | 5 |

| Portfolio management | 5 |

| Private banking | 5 |

| Financial Ethics | 5 |

| Workshop: Taxation of investment products | – |

| Workshop: Insurance and pension plans | – |

| Workshop: Regulation and normative framework | – |

| Workshop: Investment simulator | – |

| Master’s Final Project | 10 |